Introduction

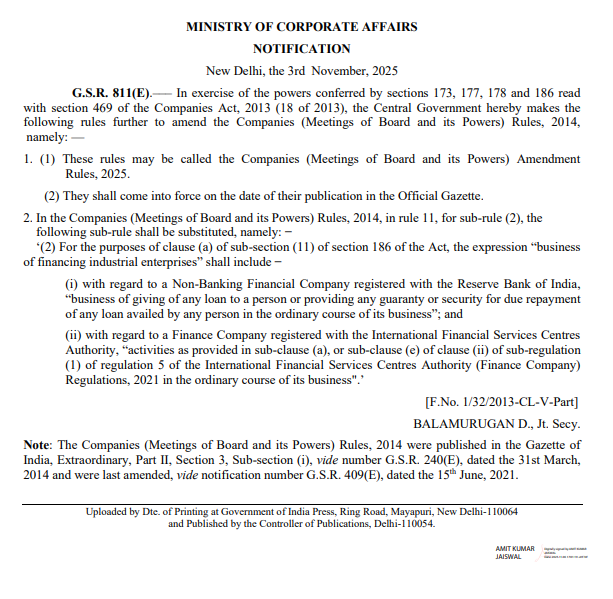

Ministry of Corporate Affairs issued a new notification on 3rd November 2025 known as G.S.R. 811(E). This amendment changes the Companies (Meetings of Board and its Powers) Rules, 2014. It mainly modifies Rule 11(2) related to Section 186 of the Companies Act, 2013. The amendment clarifies the meaning of the term “business of financing industrial enterprises.”

Basic Details of Notification

The amendment is called the Companies (Meetings of Board and its Powers) Amendment Rules, 2025. It came into force from the date it was published in the Official Gazette. The notification was issued by Shri Balamurugan D., Joint Secretary, Ministry of Corporate Affairs.

Key Amendment Introduced

The key change made is the substitution of sub-rule (2) of Rule 11. The new sub-rule now defines “business of financing industrial enterprises” in two parts. First, for Non-Banking Financial Companies (NBFCs) registered with the Reserve Bank of India, the business includes giving loans or providing guarantees or security for repayment of loans in the ordinary course of business. Second, for Finance Companies registered with the International Financial Services Centres Authority (IFSCA), the term includes the activities mentioned under Regulation 5 of the IFSCA (Finance Company) Regulations, 2021.

Purpose of the Amendment

Before this amendment, there was no clear definition of what “business of financing industrial enterprises” meant. This created confusion about whether certain financial activities were exempt under Section 186(11)(a) of the Companies Act, 2013. The new rule now clarifies that both NBFCs and IFSCA-registered Finance Companies are covered under this definition.

Objective and Impact

The main objective of this amendment is to bring clarity and align the provisions of company law with the regulations of financial sector authorities like RBI and IFSCA. Now, when NBFCs or IFSCA Finance Companies give loans, provide guarantees, or offer security in their regular business, these actions will be treated as part of their normal financing activity. They will not be required to take additional approvals under Section 186.

Illustration

For example, an NBFC that provides loans to clients in its daily operations is clearly engaged in the business of financing industrial enterprises. Similarly, a finance company operating under IFSCA that provides financial guarantees or other lending services under Regulation 5 will also fall under the same category. This saves such companies from unnecessary compliance burdens.

Applicability for Other Companies

Companies that are not NBFCs or IFSCA-registered finance companies must continue to follow all provisions under Section 186. They need board and shareholder approvals for loans, guarantees, or investments that cross the prescribed limits.

Practical Guidance for Company Secretaries and Directors

For company secretaries and directors, it is important to check if their company qualifies under these categories. If yes, the company should record this in its board minutes while approving loans or guarantees. It must also ensure that such activities are within the ordinary course of business. Proper documentation should be maintained to show compliance with this rule.

Conclusion

This amendment will help financial companies operate with better clarity and confidence. It will also support the growth of India’s financial ecosystem by aligning corporate law with regulatory developments in IFSCs like GIFT City. In conclusion, the Companies (Meetings of Board and its Powers) Amendment Rules, 2025 is a small but significant step toward simplifying business compliance. It ensures that NBFCs and IFSCA finance companies can carry out their financing operations without confusion or duplication of approvals under Section 186. The change promotes transparency, reduces compliance pressure, and strengthens the ease of doing business in India.